reit dividend tax rate

This means that dividend income will be taxed at a lower rate than the same amount of interest income. Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax credit in Canada.

Guide To Reits Reit Tax Advantages More

Investors in the highest tax bracket pay tax of 39 on dividends compared to about 53 on interest income.

. Investors in the highest tax bracket pay.

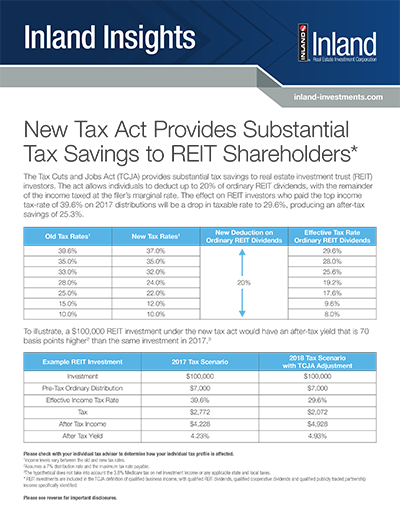

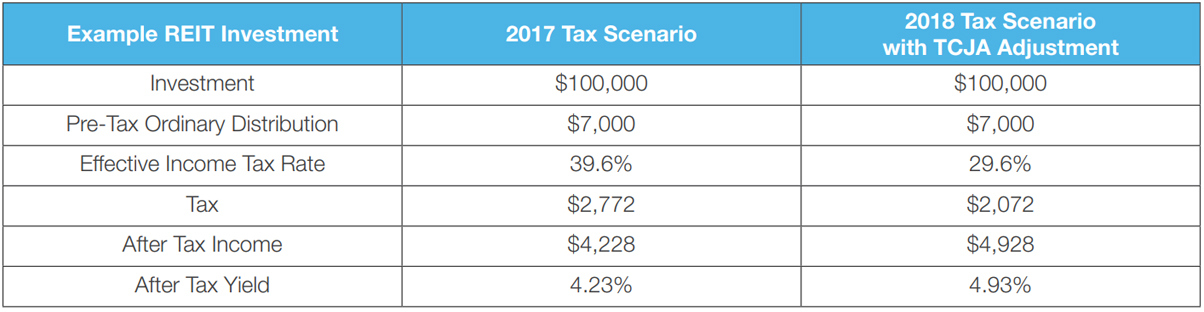

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

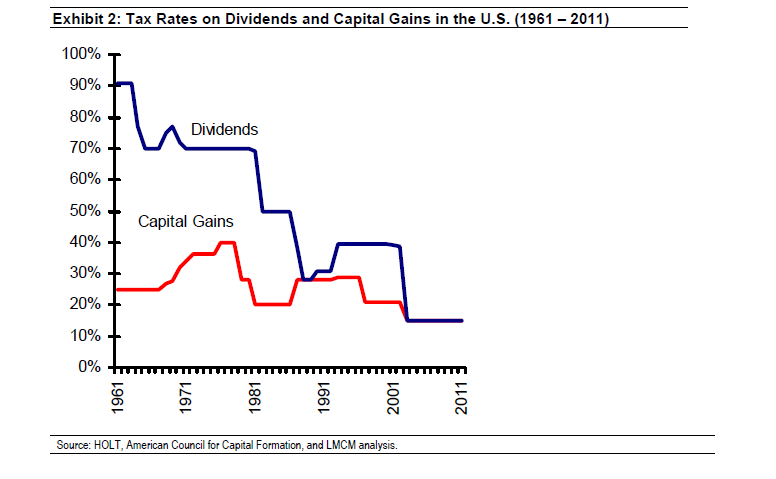

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

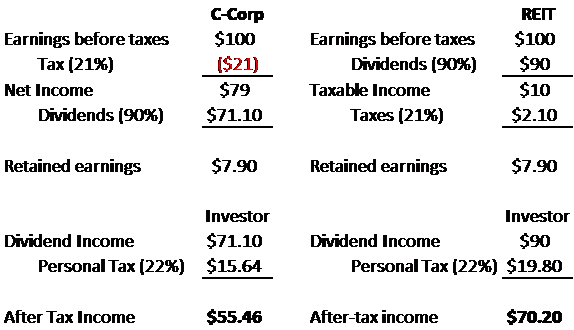

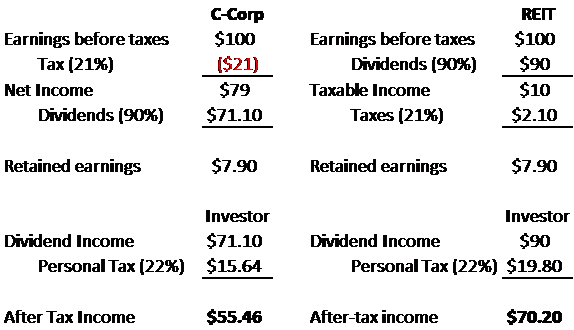

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

How To Pay No Tax On Your Dividend Income Retire By 40

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

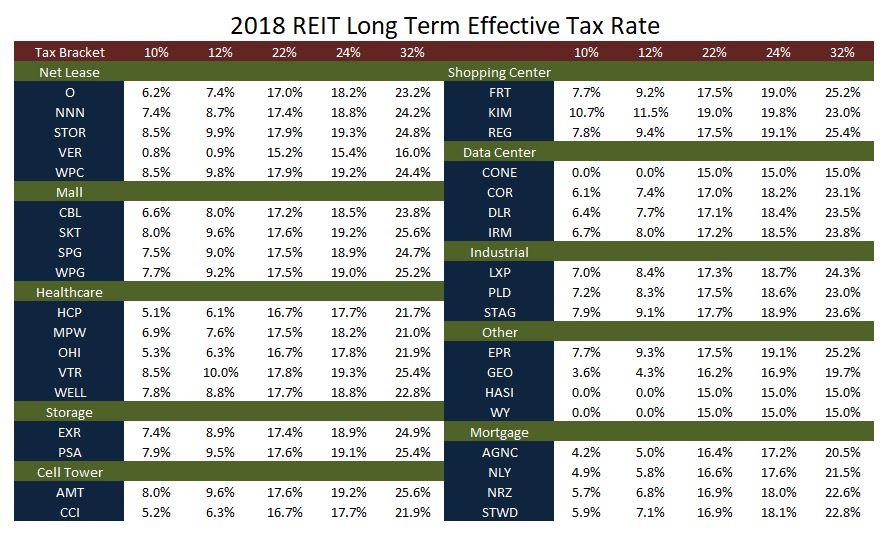

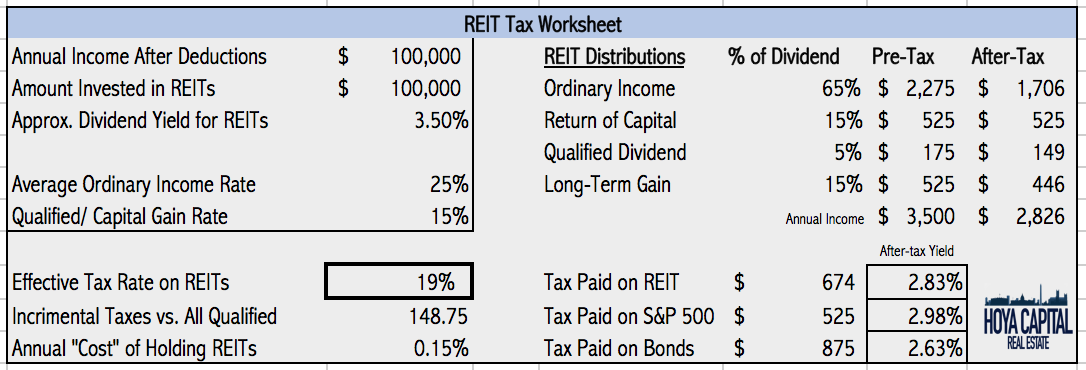

How Tax Efficient Are Your Reits Seeking Alpha

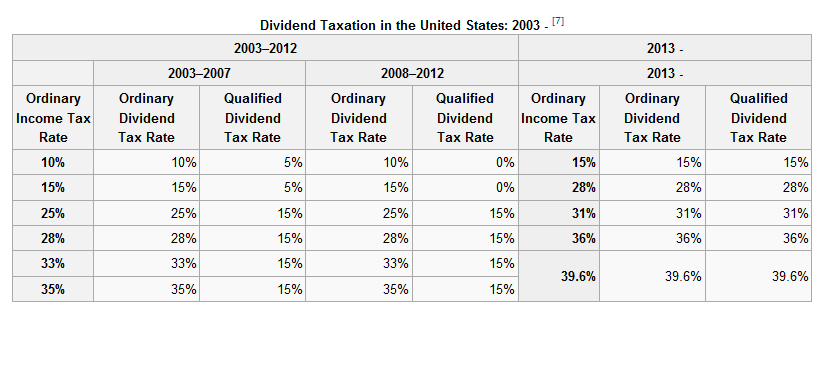

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

The High Yield Potential From Reit Dividends Considering Taxes And Safety

Sec 199a And Subchapter M Rics Vs Reits

Guide To Reits Reit Tax Advantages More

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments