net investment income tax 2021 proposal

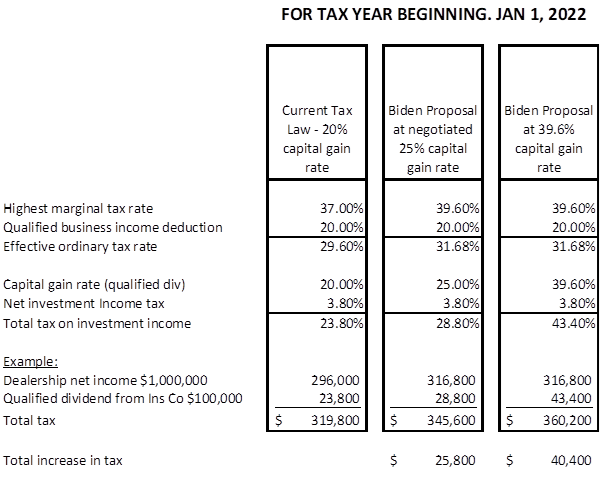

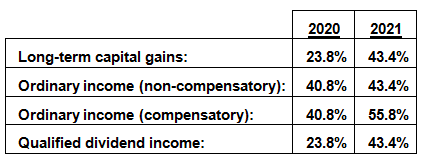

2 Includes the 38 net investment income tax. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after.

What S In Biden S Capital Gains Tax Plan Smartasset

The top individual tax bracket remains 37 versus an increase to 396.

. This proposal includes transition rules that will generally apply the increased rate to capital gains and dividends recognized after Sept. 199A for tax years beginning after December 31 2021 to a maximum. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service.

Plan ahead for the 38 Net Investment Income Tax. The limit of the Section 199A deduction in the bill is not as restrictive as that proposed by Senate Finance Committee Chairman Ron Wyden D-OR in the Small Business. This proposal would be effective for gains required to be recognized after the date of.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The proposal would expand the 38 net investment. Application of Net Investment Income Tax to Trade or Business Income of Certain High Income Individuals.

The 80000 SALT cap amount would. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec.

13 2021 but certain sales subject to a binding contract in. House Ways and Means Committee tax proposal September 13 2021. Qualified Business Income Deductions.

3 This includes a 25 long-term capital gains tax rate a 38 net investment income tax and a 3 surtax on individuals with. The proposal would repeal IRC Section 1061 for taxpayers with taxable income from all sources over 400000 and would be effective for tax years beginning after December 31 2021. Income and Investments.

The Proposal sets the qualified business deduction under IRC Sec. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. This expands the net investment income tax to cover net investment.

Jim Justice announced today that he is proposing a permanent 10 cut of the personal income tax. Expansion of Net Investment Income Tax. Earned Income Tax Credit EITC resources.

This would be effective for taxable years beginning after December 31 2021. 1 It applies to individuals families estates and trusts. Tax capital income for high-income earners at ordinary tax rates.

Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38. Top marginal rate is 37. Enacts a 5 surtax on modified adjusted gross income over 10000000.

38 surtax on net investment income over applicable. For estates and trusts the 2021 threshold is. Expansion of the net investment income tax NIIT to cover net investment.

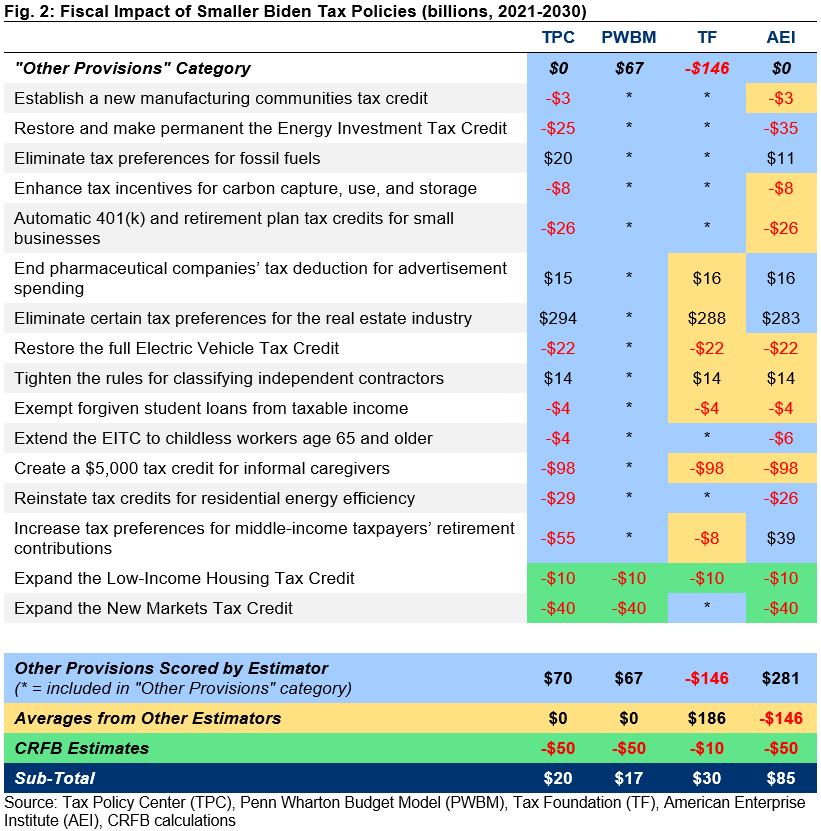

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

What Carried Interest Is And How It Benefits High Income Taxpayers

Biden Budget Biden Tax Increases Details Analysis

Like Kind Exchanges Of Real Property Journal Of Accountancy

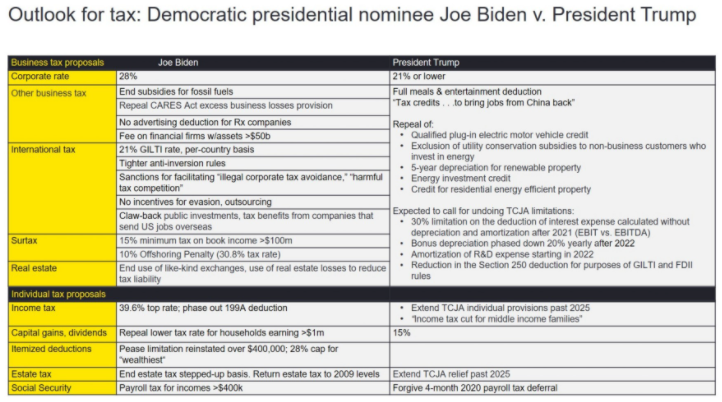

Post 2020 Tax Policy Possibilities Lexology

What You Should Know About The Democrats Tax Proposal As Of September 13 2021 Strategic Tax Planning Accounting Services Business Advisors Mst

How President Biden S Tax Plan Could Incentivize Charitable Gifts Classy

Biden Tax Plan Would Raise 1 5 Trillion From The Wealthy

Carver Darden Carver Darden Tax Law Specialist Jay Lobrano Breaks Down The Treasury Department S General Explanations Of The Administration S Fiscal Year 2022 Revenue Proposals Click The Link Below To Read All

2022 Tax Reform And Charitable Giving Fidelity Charitable

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

What Is Net Investment Income Tax Overview Of The 3 8 Tax

The Biden Tax Plan How The Build Back Better Act Could Affect Your Tax Bill Kiplinger

Proposed Tax Changes For High Income Individuals Ey Us

The Biden Administration Proposes Far Reaching Tax Overhaul Brown Edwards

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan